Contents:

If the https://1investing.in/ falls 15% from your entry price, sell the stock immediately. And retired hedge fund manager, Matthew Kratter will teach you the secrets that he has used to trade profitably for the last 20 years. Imagine what it would be like if you started each morning without stress, knowing exactly which stocks to trade.

Trudeau, buoyed by Biden visit, visits Council on Foreign Relations … – rdnewsnow.com

Trudeau, buoyed by Biden visit, visits Council on Foreign Relations ….

Posted: Fri, 28 Apr 2023 08:11:19 GMT [source]

RSI is also useful in identifying if there’s an uptrend or downtrend. If RSI shows signs of overbuying, it generally indicates that it’s the right time to sell and make a profit. Likewise, when RSI shows signs of overselling, it is an indication that it’s the right time to buy. It is an oscillator that measures price changes and also the rate at which such changes are taking place. Market participants can spot signals by observing the divergences and inefficient swings.

Long-term Momentum:

Amalgamation of big data and algorithmic trading provided i highly optimized insights for traders to make maximum returns from their investments. Both uptrends and downtrends can be represented by the Positive Directional Indicator (+DI) and the Negative Directional Indicator (-NDI). Thus, ADX usually consists of 2 individual lines, which give an indication to the traders whether to go long or short.

The goal of the momentum trading technique is to profit from the market’s ongoing movements. When the price of a share is strongly rising in one direction, momentum traders typically take the position and exit when the trend reverses. Thus, identifying the trend and selecting the shares with significant momentum is necessary for momentum trading. Moreover, traders can utilize different momentum trading strategies. The first factor for implementing a momentum trading strategy is volume of the asset.

The main motto of every strategy is to extract maximum profit with minimum risk. However, implementing and using these strategies requires expertise and knowledge. Momentum trading is a technique where traders buy and sell financial assets after being impacted by recent price trends. Traders tend to take advantage of uptrends or downtrends in financial markets until the trend begins to fade away.

We cover topics related to intraday trading, strategic trading, and financial planning. A momentum trader must know in advance his entry and exit strategy. He can enter the stock when there are signs of short-term strength or he can wait for a pullback and buy on weakness. Similarly, depending on his expectation of profit and risk appetite, he must determine his exit strategy. There are various factors which bring volatility in different sectors like a change in the laws pertaining to a particular sector or a major event affecting a particular sector.

What is Momentum Trading

So, in today’s blog, we will discuss momentum investing, the indicators used in momentum trading, and some strategies. Also, if a stock’s price begins to increase due to a suspected short squeeze, momentum traders may buy shares in the hopes that the short squeeze will continue to push the price higher. The market price typically rises when an asset increases because traders and investors become more interested. This keeps happening until a lot of sellers come into the market. Your sell order will be placed at a predetermined level above the current price so that when it is triggered, you exit your position with a profit. Is part of the IIFL Group, a leading financial services player and a diversified NBFC.

The performance of momentum funds is dependent on a single factor. The biggest drawback of momentum funds is the lack of diversification and instability of returns. In the worst scenario, if the stock prices fall, you will likely face huge losses due to your dependence on the momentum. When the momentum indicator’s first version is a positive number, the price is above the price “n” periods ago.

- RSI is also useful in identifying if there’s an uptrend or downtrend.

- Although not the initial trader engaging in this, Richard Driehaus made the strategy popular and named it.

- In a nutshell, this strategy poses a certain level of risk and necessitates extensive training and experience.

- Traders can use a moving average line to detect the current trend while removing most of the “noise” in the market that arises from small, unimportant price swings.

- It frequently compares patterns in more traditional financial markets, such as those for currencies, bonds, and commodities.

To achieve the same, investors use strategies as per their convenience. One such strategy which is used in the market is momentum trading. Let’s dive in and learn how it can be used and when, what are the best momentum indicators, to form an idea, when it is best used.

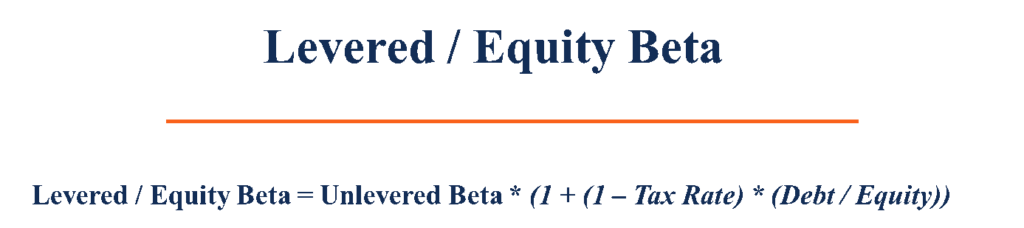

The how to read summaries on the annual financialor aims to initiate transactions that benefit from the positive direction. Momentum indicators are the tools used to measure the rate of momentum. Some of the market momentum indicators are Market Momentum Indexes, Relative Strength Index , Moving Average Convergence Divergence , and Average Directional Index. This way momentum can be calculated considering different timelines to get a more accurate idea. The investments are made against the trends, and with the calculations and analysis, the trading will snap back and make a good profit.

How Does Momentum Trading Strategy Work ?

When a range is at least $5, it is considered profitable for momentum intraday trading. Smaller price movements are better for scalping strategies, which are very common within the forex market. Though some momentum traders prefer to take positions in the long-term, one of the most appropriate strategies for trading on momentum is the short-term approach of day trading. 4) No need to issue cheques by investors while subscribing to IPO. When the trend’s momentum begins, such as a divergence between price action and the movement of momentum indicators like the MACD or RSI, the trader attempts to exit their position before the trend reverses. Traders who use a momentum investing strategy try to benefit by purchasing or selling short securities when the market is strongly trending, such as when the price action momentum is high.

To understand momentum investing, you must first understand what market momentum is. There are several strategies for intraday traders, but these are some of the best and most used. Reversal trading strategy is one of the most difficult where the intraday trader chooses to go against the trend while in other strategies, traders are supposedly along with the trend. The key to successful intraday trading is to invest quickly and watch the market trend, and the final step is to decide at the right time. Intraday trading is a riskier way to invest money in the stock market and is much different from what investors do in the stock market.

Momentum trading actually goes by a stringent group of rules based on particular indicators of a technical nature that drive entry and exit points related to specific securities. Investors /Traders can use market momentum to create an investment/trading strategies. Furthermore, momentum gives an idea of potential price movements. Generally, technical traders use a 10-day timeframe to measure market momentum.

A contrarian trader trades when others are feeling pessimistic about the market. The contrarian thinks there is an opportunity because the market or stock is valued below its intrinsic value. We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information & latest updates regarding our products & services. We do not sell or rent your contact information to third parties. Please note that by submitting the above mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. Understand what moving average is, when it is utilised, and the formula used to calculate it.

How to Create a Portfolio for Momentum Trading

It occurs when the price moves directionally and persistently for the first 30 minutes from the cash market open. It is necessary to use 30-minute bars as there needs to be enough time to measure an extreme move of the cash open. This means there will be fewer trades than other strategies using… Investors who learn about momentum trading will be better able to determine when to enter a position, how long to hold a position, and, most importantly, when to exit a position. Finally, the third strategy for momentumtradingis the cross-asset strategy. Any potential investor should note that investment in the Rights Securities involves a high degree of risk.

By combining three moving averages and only exposing a simple signal, the script helps filter out noise and focus on the trend and the trade… However, if you are new tomomentum investing, you need to polish your technical analysis skills, market timing, and other strategies discussed above to profit from the market. Volatility shows that the stock price has ample room for the price movement.

- Possible theories include delayed stock price reactions to common factors, something which Jagadeesh and Titman disagree with.

- After this calculation, a 9-day EMA of the MACD, also known as “signal line” is plotted on a graph along with the MACD line.

- Buying high and selling higher is momentum traders’ main goal, but this goal does not come without its fair share of challenges and risks.

- The investor aims to initiate transactions that benefit from the positive direction.

- Cognitive bias, confirmation bias and other personal beliefs and behaviours of investors, therefore, give rise to momentum, they believe.

A pullback is a pause or moderate dip in the price of a stock or commodity that occurs within a continuing advance. So, if a stock moves above its resistance level, then it will generally go on to make a sustained upward move. Hey, I have discovered this amazing financial learning platform called Smart Money and am reading this blog on . Understand what tracking stocks are, who they are used by and the value that they provide.

Company

You can easily try your hand at momentum trading with a reputable broker like Motilal Oswal. It is important to note, though, that you should select securities that are volatile and liquid. This means that it is imperative to choose individual stocks, and not mutual funds or ETFs. Momentum trading is a method of financial market strategy that profits from sharp and quick changes in a security’s underlying price. When securities are rising, traders will look to buy them, and when they are falling, they will look to sell them.

You can also follow other indicators and combine them the same way as explained above for intra-day trading using momentum indicators. Usually, divergence is an indication that the momentum of the market price movement is stalling or is going to reverse. If movements of the market price and the momentum diverge with each other in an upward manner, it is known as a bullish divergence. And, when both of these suddenly turn downwards after moving in an upward direction, it is known as a bearish divergence. “Investments in securities market are subject to market risk, read all the related documents carefully before investing. Stop hunting is a trading strategy that involves manipulating the price of an asset in order to trigger stop-loss orders placed by other traders….

Types of Momentum Indicators

Average directional index – is used to measure when a trend is gaining or losing momentum. It is calculated based on a moving average of price action over a period of time, and shown as a single line on the graph. An ADX value is 25 or over is an indication of a strong trend, and when a value is below 25 is seen as a weak trend and momentum traders will usually avoid using strategies within this range. The higher peaks on a chart show that a trend momentum is rising, whereas smaller peaks mean that momentum is entering a downtrend, which means that a trader should exit his/her position. Something else to note about trading with a momentum strategy and forming a momentum portfolio, is to understand what a stock universe indicates.

Hot Stocks: CXAI INPX PEAR FNGR MARA RIOT – Insider Financial

Hot Stocks: CXAI INPX PEAR FNGR MARA RIOT.

Posted: Thu, 13 Apr 2023 07:00:00 GMT [source]

It also shows entry & exit of trade is convenient and the liquidity of trade is high. You put all your eggs in one basket whenever you invest in a concentrated strategy. In momentum investing, you are risking your money on the success of the stocks considering only one factor, i.e. momentum. Chasing the trend and keeping pace with it is the fundamental nature of humans. When we ride with the trend in the market, the strategy is known as momentum investing.

Momentum investing is often short-term, as traders are only interested in capturing a portion of a trend’s price movement. When an asset reaches a higher price, traders and investors are more likely to pay attention to it, pushing the market price even higher. In other words, excessive pessimism on the part of other investors has driven the stock’s price below where it ought to be. The contrarian trader will buy that before the general mood changes, and the share prices recover. Momentum traders take advantage of market volatility by taking short-term positions for stocks that are rising.

Not every stock can provide momentum; therefore finding the right stocks to trade in becomes very critical in momentum trading. A wrong stock can not only waste your time but can also incur losses. Here are 10 things that you should focus on while undertaking momentum trading strategy. Matthew Kratter is the founder of Trader University, where he brings together the best stock trading strategies and investment techniques used by professional traders. He has more than 20 years of investing experience, including serving as a portfolio manager and investment committee member at Peter Thiel’s hedge fund Clarium.